Invest in properties at low prices, cash out with higher price appreciation.

Build wealth by investing smartly in purchasing property stocks at low prices, and watch their value grow over time due to price appreciation. After 5 years the property is sold at a higher value, securing a profitable return on your initial investment.

Why you should invest in

co-owned deals

Lower entry barrier

This investment opportunity allows you to enter the real estate market with a lower initial investment than traditional property ownership. This means you can diversify your portfolio without needing substantial upfront capital.

Property appreciation

Over time, the properties you invest in are expected to appreciate in value. This price appreciation can lead to potential capital gains when you cash in your investment after 5yrs, allowing you to reap the rewards of the property market's growth.

Passive income

By investing in properties, you'll earn a share of the rental income generated by these properties. This provides you with a consistent stream of passive income that can help supplement your existing earnings or financial commitments.

Professional management

The properties are managed by professionals who handle all the operational aspects, such as maintenance, tenant management, and property upkeep. This saves you the time and effort of managing properties yourself.

Potential for high returns

The potential to earn up to 20% annually from rental income and property appreciation offers a lucrative return on your investment compared to any other investment worldwide.

Defined exit timeline

After a certain period (such as 5 years), you have the option to sell your investment and "cash out." If the property's value has increased significantly, you can enjoy a handsome profit on your initial investment.

How rental deal works

Invest early at low price point

When you invest in this product, you're getting in at an early stage when property prices are affordable. You don't need a large upfront amount; instead, you can start with a relatively lower investment like buying shares of a property compared to buying a whole property.

Earn 10% rental cashflow every year for 5 Years

As an investor, you'll earn a portion of the rent generated by the properties you've invested in at 10% per year broken down to 0.83% per month. Every month, you'll receive a share of the rental income. This provides you with a steady stream of income which you can “cash-out” without any hands-on property management responsibilities.

Cash-in investment at a higher price after 5 years

In summary, this product enables you to invest in properties with a small upfront amount. You'll earn regular rental income over 5 years at 10% per year, and when the time is right, the platform will sell the properties on your behalf at a higher price, capitalizing on the growth in property values. It's a convenient way to build wealth over time without the complexities of full property ownership, making real estate investment accessible and rewarding.

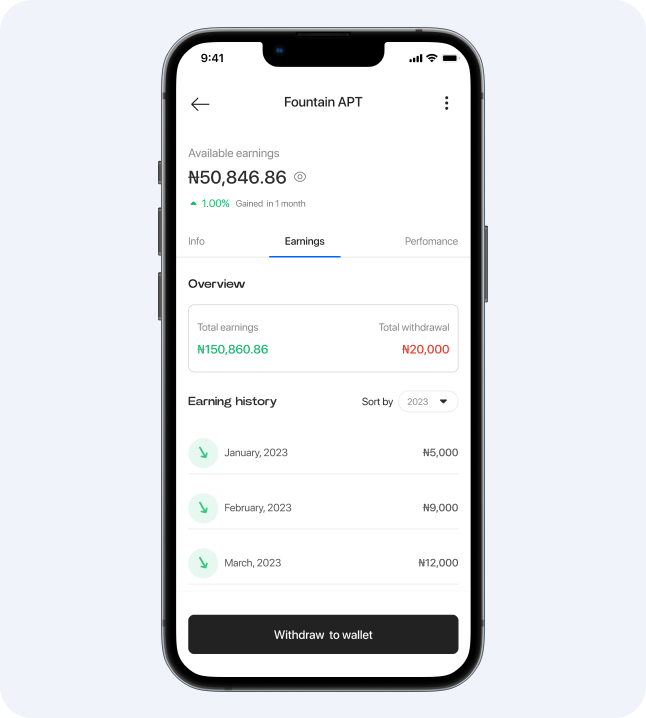

Where do I receive my monthly earnings?

Your monthly rental income is paid directly to your dividend wallet, from which you can now withdraw into your main multipurpose wallet and further to any bank account in your name. There are three core functions of your dividend wallet:

- You can view the history of your rental earnings on a particular asset, month by month, as they vary.

- You can track your simple income statement on a particular asset which includes; inflow, outflow, and balance.

- After the probation period for an asset, you can process withdrawal of rental income to your main wallet and further to your bank account whenever you desire.

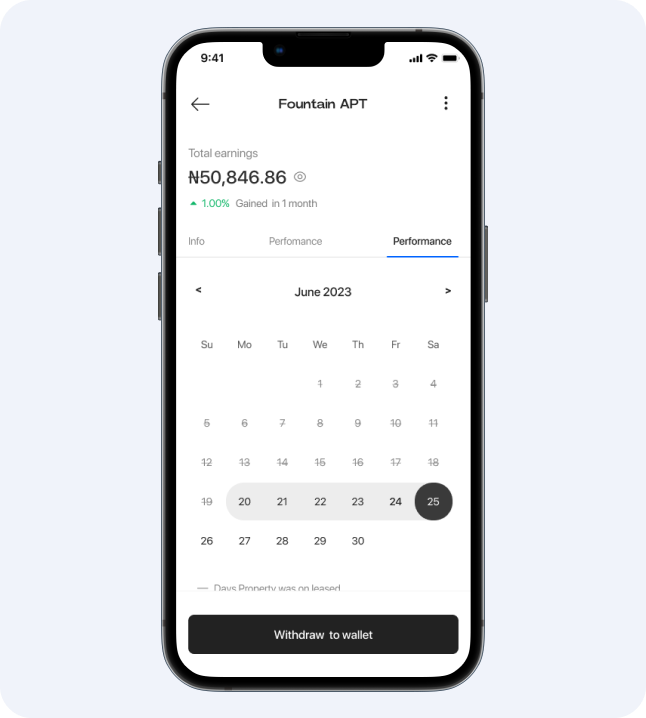

Where can I track the revenue generated by a property I invested in?

The Performance section in the property details presents a breakdown of your property's revenue through a calendar. This allows you to see the total number of nights booked, revenue earned, and profits generated. You can also access the bookkeeping of your venture to help you understand how profit is determined from revenue after expenses.